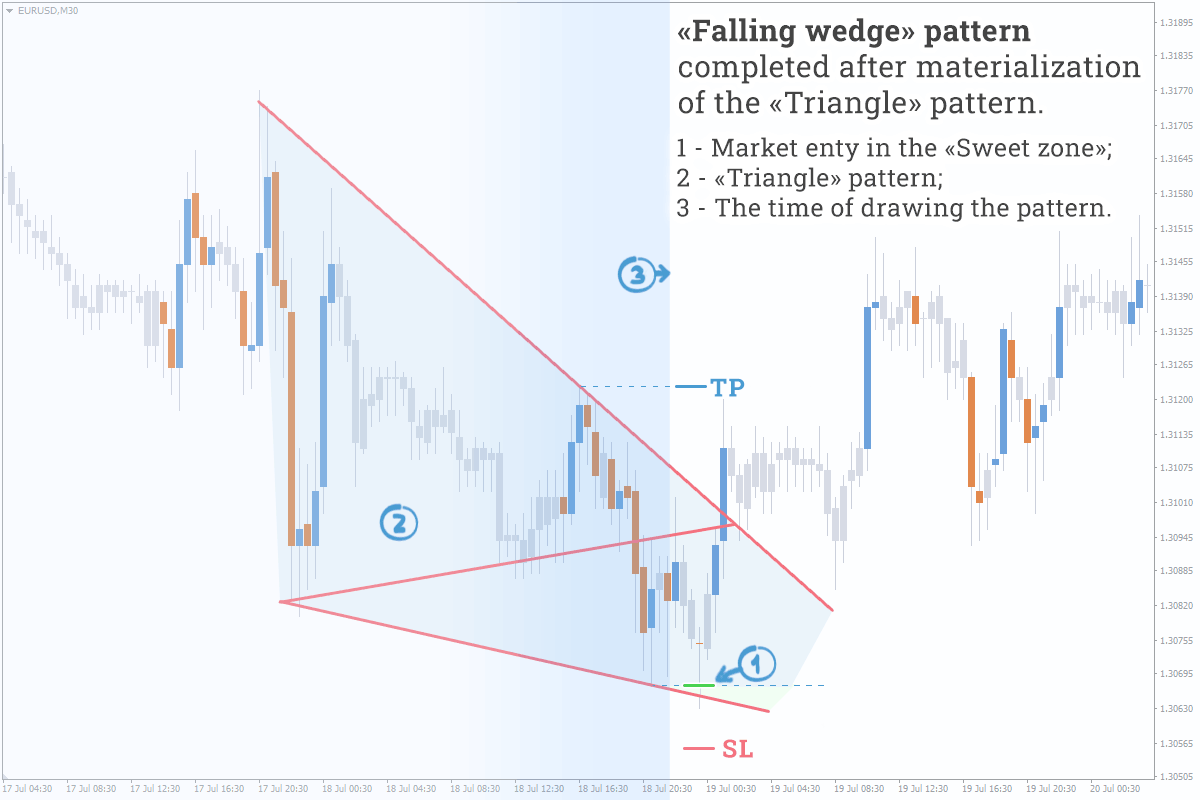

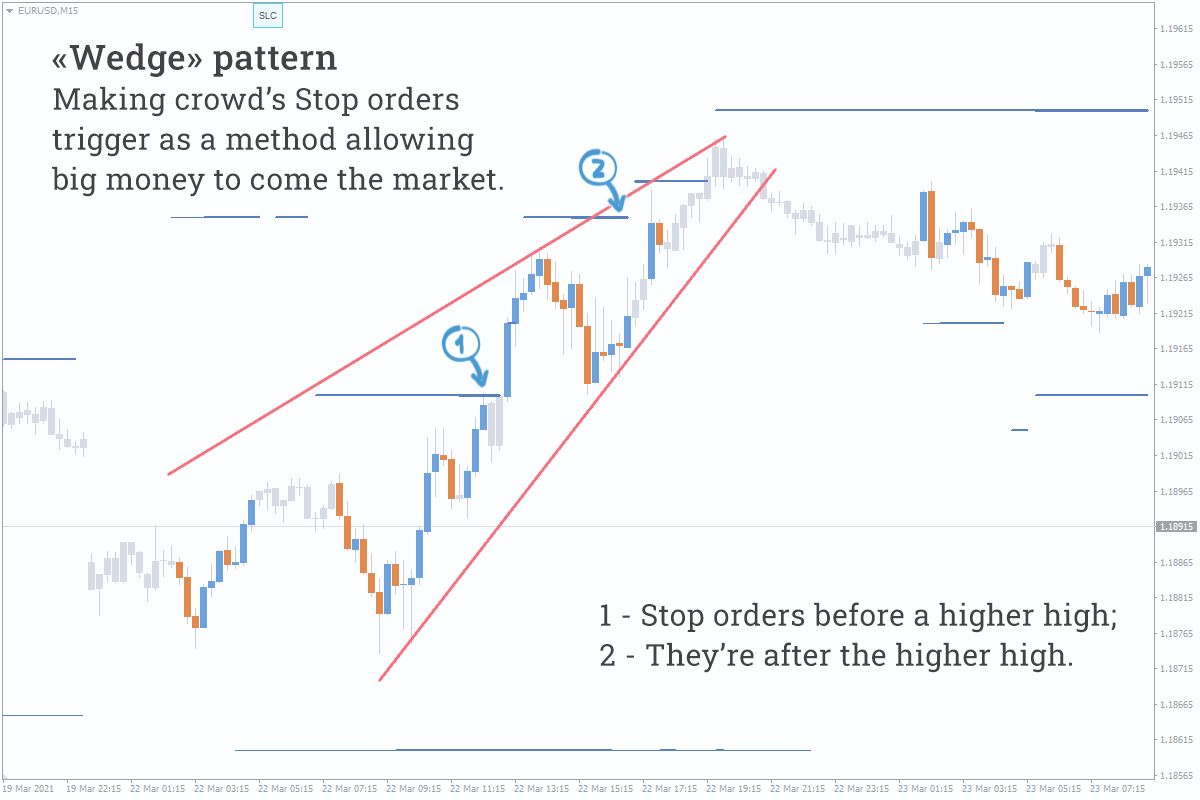

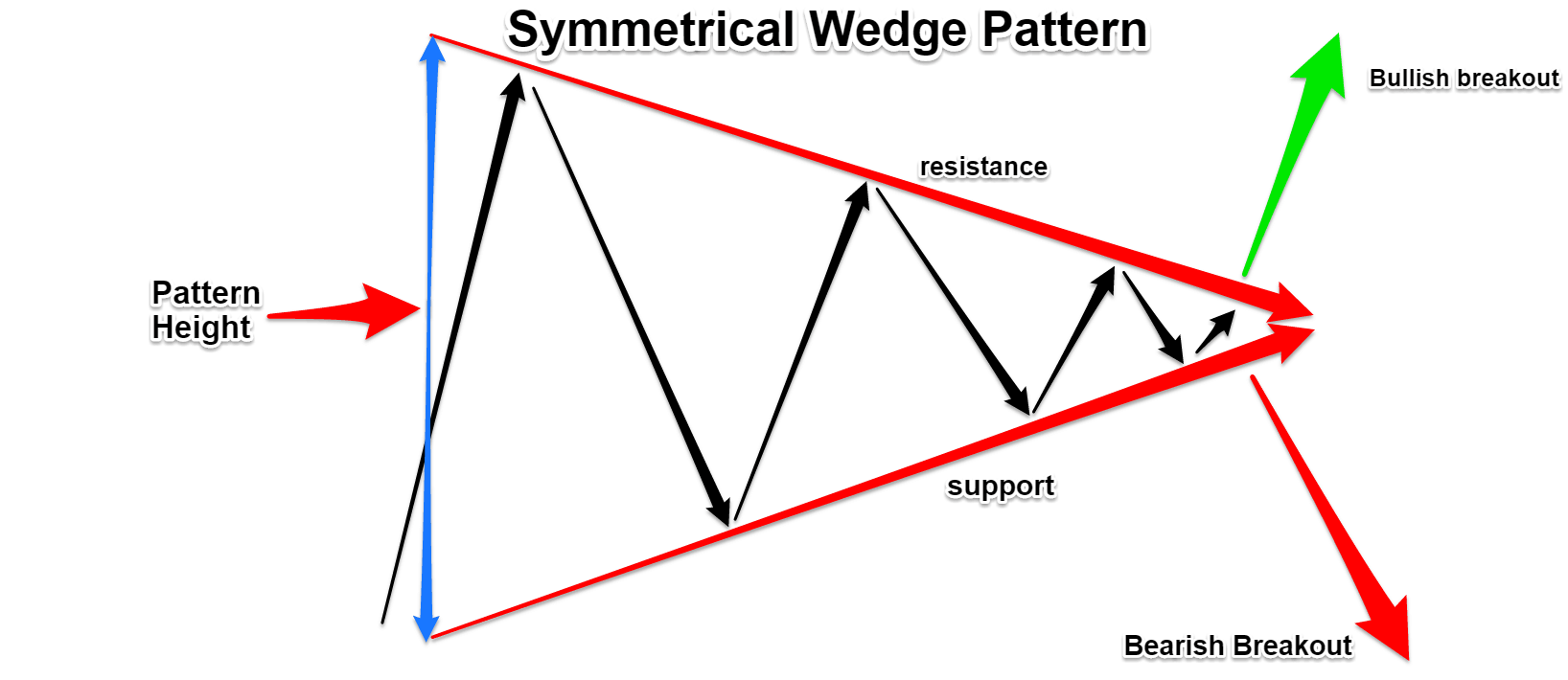

This disparity is a sign of a “healthy” consolidation period and one that is likely to lead to a continuation of the current trend. Notice how each move lower formed at a steeper angle than that of consolidation. Last but not least is the angle at which the consolidation forms. The opposite holds true for the quote currency. Said another way, the buying (demand) of the base currency outweighs that of the selling (supply) during consolidation. It happens because there are more traders interested in booking profits than there are traders who are interested in taking fresh short positions. So knowing what happens more often than not puts you one step closer to consistent profits.Īs mentioned at the beginning of this lesson, these consolidation periods can develop in different shapes and sizes, but one thing that is almost always true is that continuation patterns form against the trend. Like any other technical structure we trade, there will always be exceptions to the rule.īut being a great trader is about stacking the odds in your favor. Now, that doesn’t mean that every structure such as the one above is going to break in the opposite direction of the trend. Think of them as another exhaustion pattern. The angle of the structure above was cause for concern if you had been a buyer during this time.īecause sloping flags are very similar to rising and falling wedges, which often signal a reversal. Had you known about the implications of an upward sloping flag you could have avoided buying that break and getting trapped on the wrong side of the market.

A rally had been in place for several months, yet instead of consolidating in the opposite direction of the trend, it developed in the same direction.Īlso, note the false break above resistance. The very first thing to notice about the formation above is the angle at which it formed. Now that we’ve identified the Forex flag pattern let’s move on to the meat and potatoes of today’s lesson. It allows us to catch the trend as it resumes and gives us the ability to protect our capital with a strategically placed stop loss.

During times of consolidation, this exchange of hands becomes amplified as participants book profits or establish additional positions.Īs price action traders, it’s times like this that we need to be on high alert for favorable breakout opportunities.

That same cycle of buying and selling happens throughout the life of a trend. You likely didn’t catch the whole move but rather entered after it was established and exited before it ended. This scenario makes sense when you think about the last time you caught a profitable trend. As you may well know, a healthy trend is one that pauses from time to time to rid itself of the short-term traders and accumulate new buyers or sellers. For starters, they represent consolidation.

0 kommentar(er)

0 kommentar(er)